Allsup Benefits Coordination Services

Our experts work with employers to reduce group health plan costs and reduce administrative impact of complicated insurance transitions.

Customized Solutions & Expert Guidance

Allsup Benefits Coordination provides customized solutions and expert guidance to employers and their special employee populations who are transitioning from private group health plan coverage to more complex insurance options, such as:

Medicare

Medicare offers thousands of options for eligible participants, including traditional, Medicare Advantage and prescription drug coverage.

Healthcare Insurance Marketplace (Exchange Plans)

Marketplace plans have grown in popularity among those seeking affordable care for themselves and their family, offering similarities to coverage they received from their employer.

Medicaid

Some workers, particularly those working part-time, may be unaware they qualify for state-provided Medicaid coverage for themselves and their families.

We Make It Easy

Allsup Benefits Coordination offers employers a smooth and seamless transition for individuals who choose alternative healthcare coverage.

Individuals can expect to receive:

- A needs assessment and guidance

- Education about available healthcare options

- Eligibility review to determine coverage

- Enrollment assistance

Take Advantage of Future and Retroactive Savings

Companies can lower group health plan liability simply by converting qualified, nonworking disabled plan participants to Medicare as primary payer. These individuals are:

- Entitled to Medicare as a result of receiving Social Security Disability Insurance (SSDI), AND

- Covered by a group health plan with 100 or more participants.

Allsup also monitors long-term disability claimants' progress and status in the SSDI program. Access to full disability benefits, including monthly income and Medicare, allows self-insured employers to effectively manage benefit plans and expenses.

If your company extends group health insurance to nonworking long-term disability recipients and/or early retirees who are under age 65 and who have become disabled since separating from the company, your organization can:

- Reduce future group health plan expenditures by approximately 71 percent for these individuals by converting Medicare to primary payer.

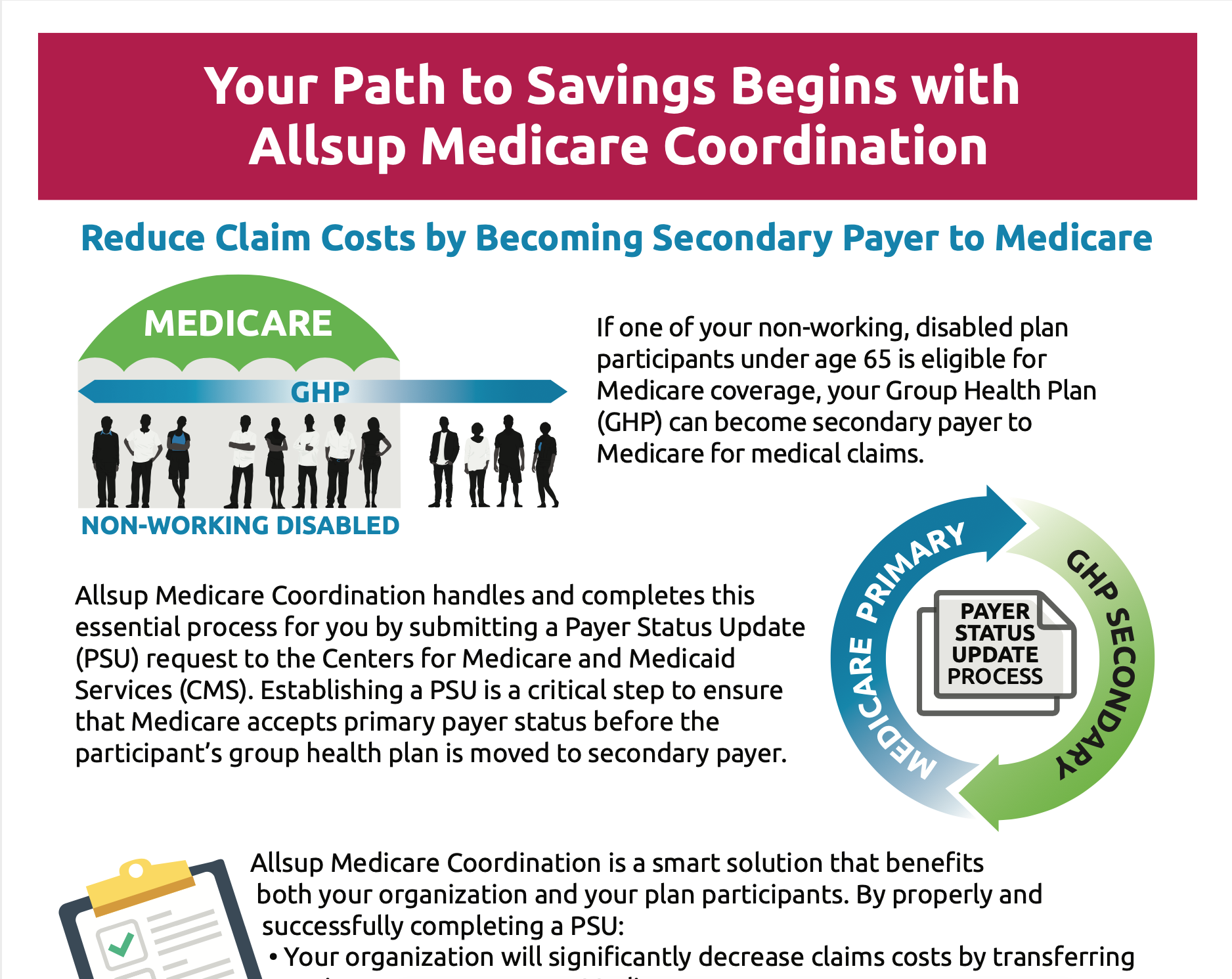

Allsup Medicare Coordination will:

- Identify nonworking disabled plan participants who are entitled to medicare as primary payer.

- Update Medicare payment status by submitting payer status updates to the Centers for medicare & Medicaid Services (CMS).

- Enroll nonworking, disabled plan participants in Medicare Part B without penalty under federal Disability Special Enrollment Period (DSEP) provisions.

- Monitor disabled plan participants who will become entitled to Medicare in the future.

- Represent disabled plan participants for SSDI, which results in additional benefits for the individual, including Medicare eligibility, increased Social Security retirement benefits and return-to-work incentives.

- Resolve CMS Demand Notices requiring reimbursement for charges allegedly paid by Medicare as primary payer in error.

Your Path to Savings Begins with Allsup Medicare Coordination

Reduce claim costs by becoming secondary payer to Medicare.

How we've helped others save

The Problem

Employer was searching for ways to reduce healthcare costs for segmented higher risk populations.

The Solution

Allsup provided education and guidance to the employer's post-65 active working population, comparing the employer's current offering to alternate Medicare plan options. Participants then voluntarily transitioned off of the employer sponsored plan.

0

0

0

0

Contact Us

Contact us for additional information about Allsup and how we can benefit your business and your employees.